The Gulf of Mexico is famous for its oil and gas industry, but the region will also play an essential role in transitioning to more sustainable renewable energy sources. According to a September 2022 report from McKinsey & Co., the Inflation Reduction Act (IRA) passed last year aims to increase offshore wind energy in the Gulf through lease sales. Another goal is to broaden incentives for activities that capture and sequester carbon.

This transition took a big step forward in April 2023 when Edison Chouest Offshore (ECO), a Louisiana-based builder of oil industry vessels, announced the development of a new ship to serve the wind farm industry.

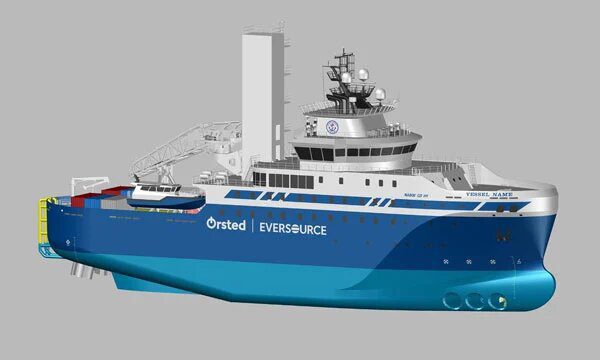

The ship, technically called a service operation vessel (SOV), will be named the Eco Edison, according to a press release. It will be engineered, built, and operated by ECO to assist with managing and maintaining three offshore wind operations in the Northeast: the Revolution Wind Farm, South Fork Wind Farm, and Sunrise Wind Farm. ECO is partnering on the project with green energy company Ørsted North America and residential energy provider Eversource.

The SOV is expected to be delivered in 2024, Baird Maritime reported. Upon delivery, the ship will “immediately provide operational support” out of Port Jefferson, NY, for Ørsted and Eversource’s joint venture offshore wind portfolio.

The main purpose of the Eco Edison is to serve as a base of operations in the sea. It will house and transfer technicians, tools, and parts to and from the wind turbine generators.

Gary Chouest, president of ECO, said in a statement that wind energy represents an “unprecedented opportunity” because of the sheer scale involved. As of April 2023, a dozen offshore wind projects were already planned. Ten additional offshore wind leases were signed, and six more were waiting to be awarded.

“In aggregate, there is a pipeline of well over 25,000 megawatts of power to be produced by over 1,700 wind turbines across 13 states, and in various stages of development that will require an incredible array of vessels, resources, knowledge, and capital commitment to install, operate, and repair,” Chouest said.

“We’re unique in the U.S. offshore marine vessel industry with our own in-house engineering group, our own shipyards, and a wealth of expertise in the offshore industry, putting us in a dominant position in the industry with the unique capability to engineer, construct, and operate specialized vessels for this market,” he continued.

Wind turbines “won’t be sprouting in Gulf waters right away,” Fast Company reported. First, there are some challenges to overcome — including slower wind speeds in the region. But longer term, Ørsted Americas CEO David Hardy says that Gulf cities and companies will be “a big part” of developing a successful offshore wind industry.

Earlier this year, Louisiana Gov. John Bel Edwards announced that oil giant Shell would invest $10 million in Gulf Wind Technology. The New Orleans-based company aims to bolster the economic performance of operational wind farms.

The partnership will develop turbine components designed to operate in the Gulf, Maintenance World reported.

“Wind resources in the Gulf region are more variable than what you find on the east coast where most of U.S. offshore wind development activity is currently happening,” James Martin, Gulf Wind Technology CEO, said in a March 13 press release.

“Seasonal hurricane conditions and moderate average wind speeds create a situation that requires a novel approach to the application of technology and the framework in which it is both developed and demonstrated,” he continued. “The program has been specifically created to address and fulfill this need and enable next steps for the region and for the industry.”