The electric vehicle (EV) transition has raised questions about how to sell the cars. The traditional dealership is not as popular as it used to be, with more sales switching to online marketplaces from showroom floors.

General Motors (GM) is hoping to stick with a mix of dealerships and online sales, but the biggest challenge will be to get dealership owners up-to-date with EV sales protocol and maintenance. One GM brand, Buick, has a plan for dealerships that are hesitant to adopt EV sales.

Buick’s vice president Duncan Aldred confirmed in September 2022 that Buick will be moving to EV-only sales by 2030. With roughly 2,000 Buick dealers nationally, this is challenging, especially the further you get into middle America. The EV infrastructure isn’t up to scale there as it is in states like California or New York. Those that don’t make the necessary adaptations will be given “an off-ramp” — dealerships that don’t shift to EV sales will be bought out by Buick and GM.

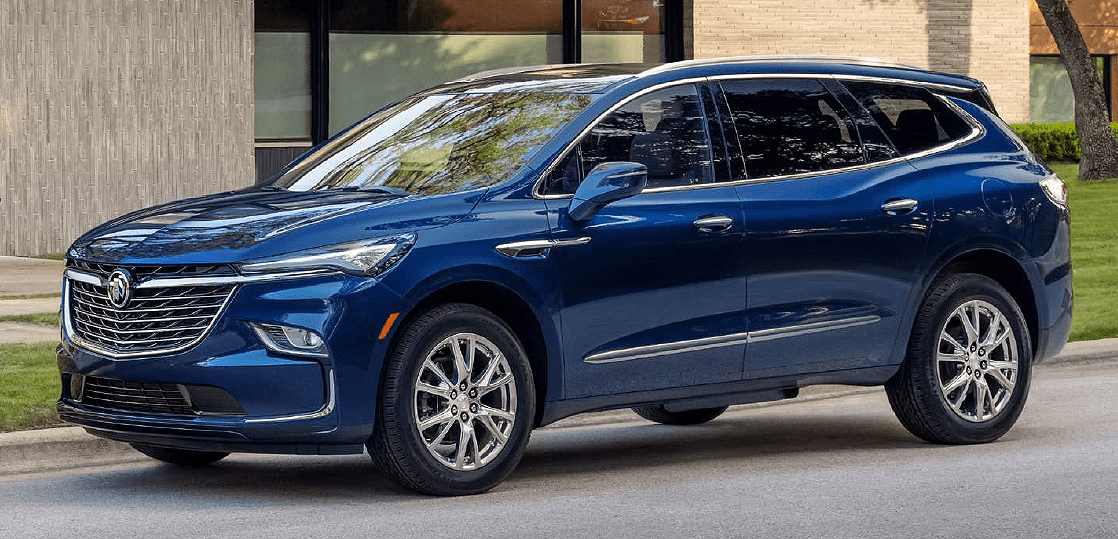

With the first Buick EV, the Electra, expected to go into production in 2024 as a 2025 model, now is the time to get dealers primed for this automotive revolution.

However, changing a car lot over from internal combustion to electric motors isn’t cost-friendly. Reports suggest it could cost up to $300,000 to install chargers and other necessary components for EVs.

“Not everyone necessarily wants to make that journey, depending on where they’re located or the level of expenditure that the transition will demand,” Aldred said. “So if they want to exit the Buick franchise, then we will give them monetary assistance to do so.”

Aldred expects the buyout process to be similar to that of Cadillac dealers, with several hundred dealerships ending partnerships with Buick. It’s unclear how much money dealerships will receive should they be bought out.

The car-buying process is changing in light of EVs becoming more mainstream. For one thing, showroom sales are becoming outdated, with EV buyers more likely to order online and dealers delivering to someone’s home.

More carmakers are adapting to Tesla’s model, with a smaller retail-style sales floor and online marketplace.

The market for Buick is also more global than one might anticipate. China is one of its biggest markets, with cars selling more than four times more than in America. The brand only has 1.2% of the American market share. However, that hasn’t stopped GM from upping production for battery cells and opening more factories for EV production.

Buick is starting to grow more in the American market as the cars become more attractive to new car buyers. In 2021, retail sales grew by 7.6%, and 73% of sales were for new Buick drivers. The hope is that this trend can carry over to EV sales, especially with Chevy and GMC also going electric.

With new vehicles come new sales practices. The good news is that Buick and GM won’t leave dealers in the dust if they can’t or don’t want to adapt to these changing times.