One byproduct of the rise in solar power is that it has led to growth in the market for virtual power plants or VPPs. These are networks of decentralized, medium-scale power-generating units that connect households, businesses, and their batteries to help manage the flow of energy and reduce reliance on the grid during periods of higher demand.

Put more simply, VPPs help ensure that “when the power goes out, solar power and energy storage kick in for uninterrupted electric supply.” That’s how Swell Energy describes the technology on its website – and it should know. The Los Angeles-based startup develops energy management and smart grid solutions, including VPPs, with the goal of accelerating the mass adoption of clean energy technologies

Swell Energy serves both homeowners and businesses with financing and virtual power plant programs, helping customers reduce costs for solar energy generation and storage systems while also lessening the risk of power outages.

The company partners with local solar and solar+storage firms to connect customers who have or want batteries for their solar-equipped homes or businesses with the right technologies.

Swell creates VPPs by linking utilities, customers, and third-party service providers together, and by aggregating and co-optimizing distributed energy resources through its GridAmp software platform. It structures contracts and financing in a way that reduces the cost and complexity of signing up new customers and technology vendors.

The company’s VPPs provide a variety of grid service capabilities through projects in Hawaii, California, and New York, helping utilities meet mandates to deliver cleaner energy to customers and reduce the grid’s dependence on fossil fuel plants. For example, Swell works with multiple California utilities to expand residential participation in capacity bidding programs. The efforts are part of the California Public Utility Commission’s goal to reduce the state’s load during emergency power events.

Swell looks to expand its reach following a November funding round that raised $120 million. The round was led by SoftBank Vision Fund 2 and Greenbacker Development Opportunities Fund I, with participation from Ares Infrastructure Opportunities and Ontario Power Generation Pension Fund. It brought Swell’s total equity capitalization to $152 million.

The money will be used to support Swell’s development of 600-megawatt hours of VPPs through the deployment and aggregation of 26,000 energy storage systems located at homes and businesses across the United States.

In addition to developing more projects with current utility partners, Swell will pursue projects in underserved markets where grid services are needed to strengthen and modernize infrastructure.

“Utilities and investors have understood the importance of virtual power plants for some time now, [and] this funding further signals that the capital markets see tremendous value in this new asset class,” Swell Energy CEO Suleman Khan said in a press release. “Virtual power plants are the key to a cleaner energy future at scale. Through the use of our GridAmp software, we are dedicated to enabling an accelerated transition to a carbon-neutral future compatible with the needs of both utilities and the communities they serve.”

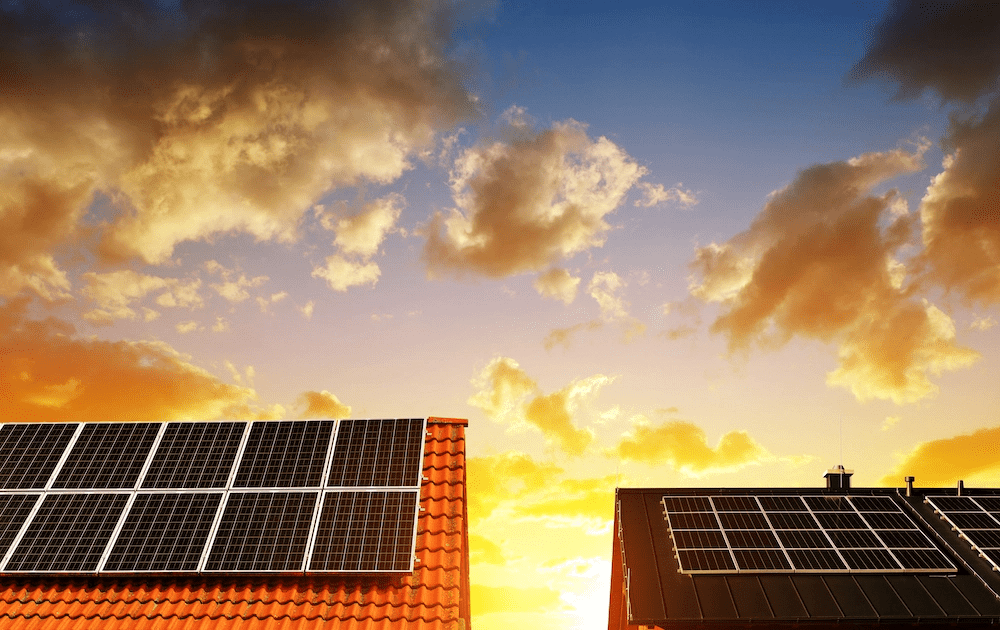

Khan co-founded Swell in 2015 after previously working with electric vehicle maker Tesla. It was a risky move at the time because there still wasn’t much of a market for home batteries or virtual power plants.

“Many of the companies back then believed that the home battery was like the proverbial fries with your solar panel burger,” Khan told Forbes in a recent interview. “It was seen as a condiment that some people may choose to get, but others wouldn’t. Our thinking was, batteries will change people’s whole attitude towards energy. We approached people who already had solar and started upselling the batteries to make their systems complete.”

Many utilities initially resisted the VPP model because it was considered a threat to their own business. However, they came around after realizing that when you add home batteries to solar-powered homes, could relieve stress on the grid. Meanwhile, the market for VPPs has rapidly expanded into other parts of the country.

“And as we get to 2024, I think you will see more utilities in the Southeast and Northwest adopt virtual power plants,” Khan said. “It’s like an imperfect storm, where potential outages and a capacity shortage have come together to create this massive need for new dispatchable energy services.”