A lot can happen in one year: entire legacies can be carved out, or once promising plans can be gutted and fail. The infamous pirate Blackbeard’s name was built on only slightly more than one year of piracy. However, the original version of the Magna Carta, one of the inspirations for the U.S. Constitution, was reworked after a year and reissued without its most essential element: the clause that limited the king’s power.

Aug. 16 marked one year since the passage of the 730-page Inflation Reduction Act (IRA) in the U.S. According to the Congressional Budget Office, it is only the first year in a decade-long plan promising $391 billion in investments in climate and energy initiatives. Other projections differ — Credit Suisse claims it will be closer to $800 billion, while Goldman Sachs said $1.2 trillion was more likely.

And while “$1.2 trillion of government spending could be viewed as a large number,” Cassie Bowe, partner at Energy Impact Partners (EIP), told TechCrunch, “what we think about a lot is the multiples on that that will be invested by private capital managers like EIP who are deploying into this space.”

More Relief To Come

It is also important to note that not all of the spending and incentives have been fully rolled out yet. In terms of pieces of legislation aimed at consumers, tax credits for electric vehicles (EVs) and home energy efficiency upgrades are already here. However, green hydrogen tax credits are among those still being worked out.

Moreover, the IRA’s rebates — the Home Energy Performance-Based, Whole-House Rebates for residential retrofits and the High-Efficiency Electric Home Rebate Act that covers rebates for electric appliances — have yet to be implemented by states and tribes, possibly beginning later this year.

Photo Courtesy Environmental Defense Fund

While there is still a lot coming, much has already been done. For such a far-reaching piece of legislation, it is incredible that public funding announcements have arrived at an almost dizzying pace.

“One doesn’t expect the federal government to move quickly, but they have,” Ramanan Krishnamoorti, vice president of energy and innovation at the University of Houston, told Grist. “I was extremely skeptical that they would actually be where they are today.” And that federal action has been supplemented by an enthusiastic private sector.

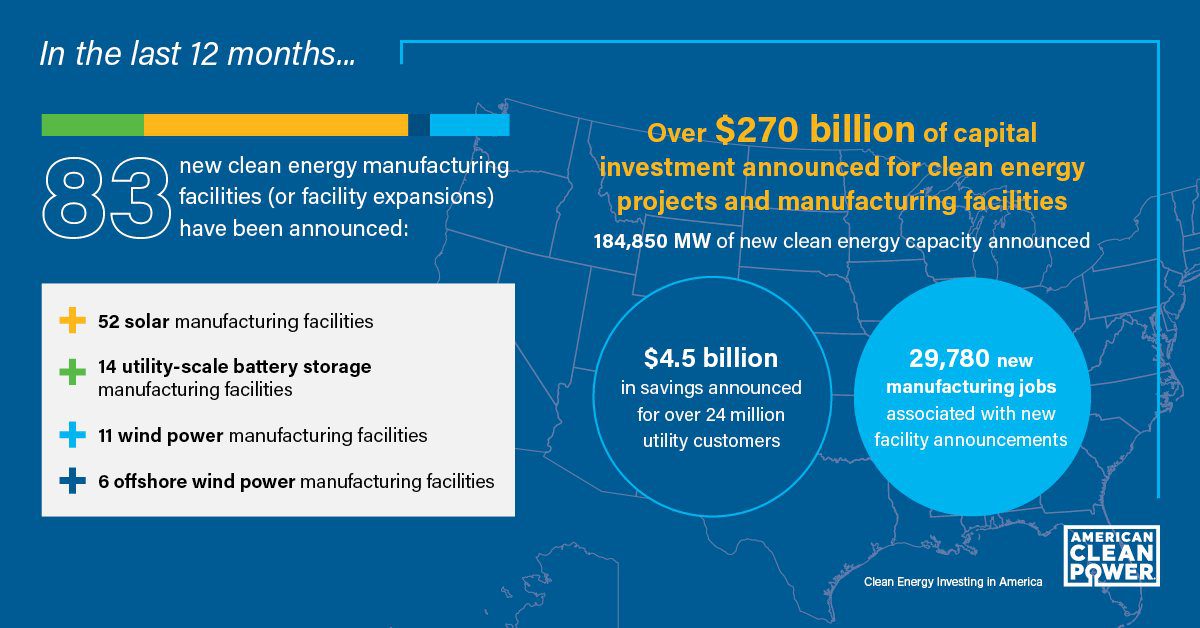

After examining the battery storage, solar, and onshore and offshore wind industries, the American Clean Power Association (ACP) says $271 billion in domestic utility-scale clean energy investments have been announced since last August. They were made up of $146 billion for new projects, $69 billion in supply agreements, $35 billion in “other” investments, and $21 billion in new manufacturing investments.

The Solar Energy Industries Association (SEIA) zooms in on the solar and storage industries alone, where it claims that private U.S. companies have announced more than $100 billion in investments, with $20 billion in manufacturing. SEIA estimates 478,000 total jobs to be created by the solar industry alone by 2033, 137,000 more than would have existed without the IRA.

Photo Courtesy American Clean Power Association

According to ACP, although it occupies the smallest share of this investment, the manufacturing segment is perhaps the most interesting given what it will do for the country. Within 10 weeks of the passage of the IRA, 15 new utility-scale manufacturing factories or factory expansions were announced. One year later, that number is 83, including 52 for solar (51 according to SEIA), 14 for utility-scale battery storage, 11 for on-shore wind, and six for offshore wind.

Notably, this will equate to a 15-fold growth from 4 GWh of grid battery storage production capacity to 62 GWh (65 GWh according to SEIA) and ninefold increase from 7 GW of domestic solar module production capacity to 62 GW (85.1 GW according to SEIA). Less vital components will also see impressive growth. For example, while we are not currently producing any ingots or wafers, the U.S. will witness capacity grow to 10 GW (20 GW according to SEIA).

ACP says that 184,850 MW (about 185 GW) of project capacity and 29,780 new manufacturing jobs will come with these facilities across multiple industries. SEIA claims 155 GW of solar production capacity attached to existing announcements, 17 times more than currently available, plus more than 20,000 solar manufacturing jobs are expected to come along. It further estimates that by 2033, this will bring the U.S. cumulative capacity to 669 GW of solar power, enough to power each home to the east of the Mississippi River and 100,000 solar manufacturing jobs, tripling the size of that industry’s workforce currently.

Photo Courtesy Lightsource BP

EVs And Carbon Emissions

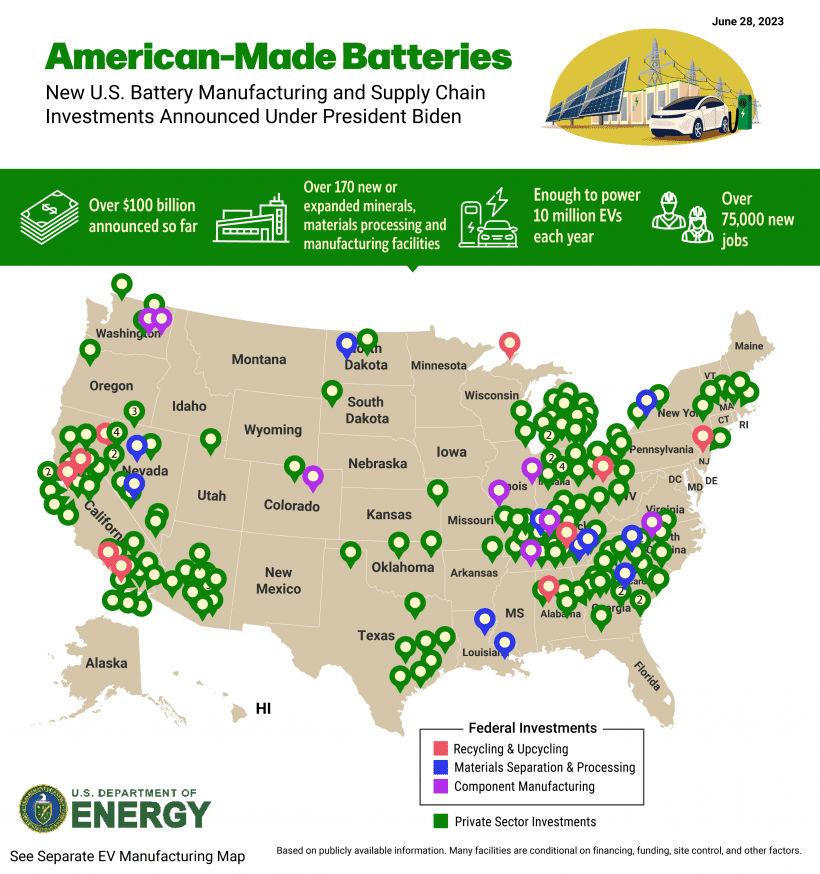

While none of those numbers include the EV sector, it plays an important part of the story. The Environmental Defense Fund estimates that since the IRA was passed, $92.3 billion worth of investment announcements have shaken the EV industry, representing about 56% of all EV announcements since 2015. They are associated with 84,700 jobs, equating to about 47% of EV jobs created since 2015.

This focus on clean vehicle production will boost cumulative EV manufacturing capacity to 4,664,800 new vehicles per year by 2026 and cumulative EV battery capacity to supply 12,165,800 new cars per year by 2027.

Photo Courtesy U.S. Department of Energy

A report from E2 tries to synthesize all these numbers, counting 210 announcements across clean energy and vehicles in 39 states. Based on the 178 announcements with information available to the public on funding and employment, E2 claims they amount to $86.3 billion in private investment and will bring 74,181 new jobs. E2 did not come up with its own estimates beyond the official ones, and thus, its investment and employment numbers are lower than in those reports that projected outward; notably, only 142 of the announcements from the last year included job creation estimates.

The country’s dedication to production is more visible in E2’s report. It says 171 of the 178 projects — representing 91% of announced investments and 95% of announced jobs — were in manufacturing, followed by 30 in generation, seven in research and development, and two in recycling. Also evident were the congressional districts benefiting from the IRA: 121 projects representing $73.8 billion in investment (86%) and 53,656 jobs (72%) were announced in Republican districts in the last year, with 18 of the top 20 being red.

Photo Courtesy E2

The most meaningful way to measure the success of this legislation will be to look at carbon emissions. In July, the Rhodium Group released a report estimating that combined with state-level action, the IRA will bring emissions 32 to 51% below 2005 levels by 2035, which is more impressive than their estimate before its passage, which was 26 to 41%.

A separate report published in Science in June places that estimate at 43 to 48% below 2005 levels by 2035, compared to 27 to 35% without the IRA. While there are low and high emissions pathways in both analyses and the result is still uncertain, Ben King, lead author of the Rhodium report, said to Grist that “those levels of deployment would be meaningfully lower than what we’re estimating in our modeling under otherwise the same conditions absent the IRA.”

Challenges, Necessities, And Resources

However, there are still some challenges to the IRA reaching its full potential that must be dealt with. Siting and permitting processes need to be sped up to enable projects to get more quickly off the ground.

An updated transmission grid capable of handling increasingly chaotic weather patterns and facilitating the movement of locally produced energy to other parts of the country is necessary. Finally, we need to hire a workforce of 1 million to do all of this.

As Jason Grumet, CEO of the American Clean Power Association, and Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, discussed on an Aug. 14 webinar entitled “Clean Energy Leaders Reflect on Bill’s Impact & Remaining Challenges,” this is a great problem to have. However, it will require implementing and scaling workforce training programs and keeping tabs on their development to ensure they reflect the nation as a whole.

Photo Courtesy Jason Grumet

Finally, when new portions of the IRA are ready for deployment, the states need to be prepared and willing to pick up the mantle, guided by carefully considered guidance issued by the Department of the Treasury and the Internal Revenue Service. We are already witnessing the necessary enthusiasm on the state level.

Earlier this year, Governor Brian Kemp pledged that Georgia would become the “electric mobility capital” of the U.S.

On April 21, Gov. Wes Moore of Maryland signed the POWER Act to increase the state’s goal for offshore wind capacity. On Feb. 2, Minnesota Gov. Tim Walz signed legislation requiring utilities to implement 100% renewable energy by 2040.

On May 2, the Massachusetts Department of Energy Resources filed the state’s largest draft Request for Proposals for offshore wind projects. On May 11, the Vermont Legislature passed the Affordable Heat Act, establishing a marketplace of clean heat credits that will limit emissions from residential, commercial, and government buildings.

Photo Courtesy Wes Moore

“The United States is effectively now the most attractive destination for global capital in clean energy and cleantech,” Aaron Brickman, senior principal of RMI’s U.S. program, told Canary Media.

And as the U.S. Department of Energy expressed: “It’s just year one, and we are just getting started.”

For a list of all the funding programs and tax incentives available through the IRA, RMI has broken the legislation down into an easy-to-use spreadsheet, and the Environmental Defense Fund teamed up with the Sabin Center for Climate Change Law to create a database and tracker. You can check out maps of the Investing in America Agenda on the White House or U.S. Department of Energy’s (DOE) websites or view state-by-state fact sheets.

To see how you can utilize these programs, the DOE’s Energy Savings Hub offers a walkthrough of electrification options, and RMI’s savings calculator can be personalized to your situation.