Among the three major fossil fuels, natural gas is easily the cleanest. According to the Center for Climate and Energy Solutions, when burned, it emits about half as much carbon dioxide (CO2) as coal and about one-third less than petroleum. However, it’s far from perfect. Natural gas combustion accounted for one-third of CO2 emissions from the U.S. power sector as of 2018, and its use as a power source has only increased since then.

On the positive side, there are ways to drastically reduce the carbon footprint of natural gas, mainly through innovative technologies that can convert it into clean energy with minimal emissions. That’s the mission at NET Power, a Durham, N.C.-based clean energy technology company.

Photo Courtesy NET Power

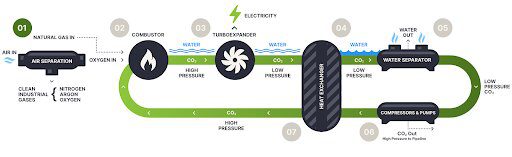

NET Power’s oxy-combustion technology captures more than 97% of CO2 emissions from natural gas power generation, the company said on its website. This kind of game-changing technology has caught the attention of leading industry players. Since its founding in 2010, the firm has received investments from giants in the oilfield services, chemical, and energy sectors, including Baker Hughes, Occidental Petroleum (aka Oxy), Constellation Energy, and 8 River Capital.

NET Power’s oxy-combustion technology captures more than 97% of CO2 emissions from natural gas power generation, the company said on its website. This kind of game-changing technology has caught the attention of leading industry players. Since its founding in 2010, the firm has received investments from giants in the oilfield services, chemical, and energy sectors, including Baker Hughes, Occidental Petroleum (aka Oxy), Constellation Energy, and 8 River Capital.

Photo Courtesy Oxy

Now NET Power is preparing for its next stage of development by building what it calls the world’s first utility-scale natural gas-fired power plant with near-zero atmospheric emissions.

In a November 2022 announcement, the company said the plant would be built near Occidental’s Permian Basin operations in Odessa, Texas. It is expected to be online in 2026.

As Canary Media reported, the plant announcement came after years of testing NET Power’s use of the Allam cycle, which combusts fossil gas so that high-pressure CO2 emissions are sent straight into a pipeline to be pumped elsewhere for use or sequestration. The testing was done at the company’s La Porte, Texas, demonstration site, which was eventually connected to the Texas grid in 2021.

Photo Courtesy NET Power

“Having demonstrated the capability of the technology at La Porte and having partnered with Baker Hughes to commercialize the NET Power system, we are excited to accelerate the deployment of this game-changing technology,” said Ron DeGregorio, NET Power CEO, in a press release. “This plant allows for the quick ramp-up in NET Power’s global deployments, providing a clear and meaningful pathway to near emission-free reliable power.”

The project targets about 300 megawatts of carbon-free power and aims to transport captured CO2 to a permanent underground sequestration location. Occidental will provide the project site along with the necessary infrastructure. Constellation will offer plant operations and power expertise, while Baker Hughes will provide know-how in key equipment and technologies. 8 Rivers Capital will provide project development support.

Photo Courtesy Net Power

“This plant will accelerate plans to reduce carbon emissions to help achieve net-zero goals,” said Richard Jackson, president of Occidental’s U.S. onshore resources and carbon management operations. “The project allows both companies to develop best practices that use NET Power’s technology to provide near emissions-free power for our Permian operations and future Direct Air Capture sites.”

In addition to being an investor in NET Power, Occidental is a customer and will use some of the plant’s electrical output to power its Permian Basin extraction work.

Occidental will also use its existing CO2 pipeline infrastructure to pump the project’s emissions into the ground for sequestration. NET Power will sell any excess generation into the Electric Reliability Council of Texas market.

Photo Courtesy Net Power

Financing for the project will be provided through a combination of NET Power’s current capitalization program, investments from existing shareholders, and new project funding. The company will also pursue government support available at the federal, state, and local levels, focusing on grant and loan opportunities available through the 2021 Bipartisan Infrastructure Law. More money could be provided through the 2022 Inflation Reduction Act.